Financial Literacy Mac OS

In this article:

- Download this app from Microsoft Store for Windows 10, Windows 10 Mobile, Windows 10 Team (Surface Hub), HoloLens. See screenshots, read the latest customer reviews, and compare ratings for Immersive Reader Offline Extension.

- We would like to show you a description here but the site won’t allow us.

Financial literacy is the ability to understand how to make sound financial choices so you can confidently manage and grow your money.

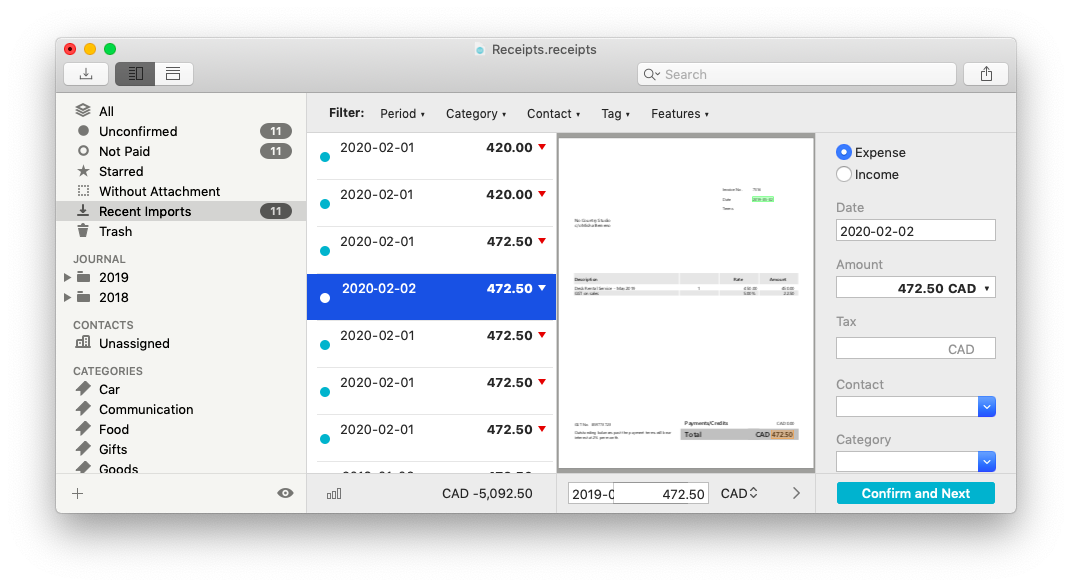

Jan 31, 2021 What makes Banktivity stand out is that its financial software designed specifically for Mac. The company claims customers can save $500 per year and about 40 hours of time by using the app. National Financial Literacy Month is recognized every April in the United States to help bring awareness and highlight the importance of financial literacy, to teach Americans how to establish good financial skills, and to encourage everyone to work on their financial wellbeing.

When you're financially literate, you're able to allocate your income toward various goals simultaneously—not just to ongoing expenses, but to savings, debt repayment and a rainy day fund too. You can navigate the financial marketplace with self-assurance, and you have the tools to thoroughly research things like loans, credit cards and investment opportunities.

Here's why financial literacy is important, and how to improve yours.

What Does It Mean to Be Financially Literate?

The Federal Financial Literacy and Education Commission, established by Congress in 2003, identified five key principles of financial literacy. Being financially literate, according to the commission, means understanding each of these components:

- How much you earn, including your pay, benefits and tax withholdings

- How to save and invest, including creating an emergency fund and setting aside money for both short- and long-term goals

- How to protect your money by buying insurance and knowing how to avoid fraud

- How to spend wisely through budgeting and comparison shopping

- How to borrow money at the lowest possible interest rate, and how to keep your credit strong with responsible repayment habits

Examples of financial literacy in action are:

- Comparing promotional periods on balance transfer credit cards so you have an extended time to pay off debt

- Increasing your retirement savings rate every time you get a raise

- Checking your credit report regularly for errors

All of these behaviors help you advocate for yourself in the marketplace, and save money in the long term.

Why Is Financial Literacy Important?

Financially literate consumers can manage money with confidence, which means effectively allocating their earnings to their goals and limiting or attacking their debt. Here are the ways financial literacy can affect your life:

- Understand how to budget: To pay for expenses, save or get rid of debt, you must understand how much income you're taking in and distribute it effectively. Making a budget is your first step toward a true understanding of money management. Once you have a budget, you can continue to track spending and revisit your spending plan regularly. There are many budgeting methods (zero-based, two-account, etc.), so choose the one that you're most likely to stick to.

- Understand and manage debt: When you are financially literate, you recognize the importance of seeking out the lowest interest rates when comparing loan terms. You also know that paying off credit card balances each month is your best bet for preventing interest charges and high credit utilization, which affects your credit score. If you already have debt, financial literacy can help you choose the best methods to get out of debt, either on your own or with the help of financial products such as debt consolidation loans or balance transfer credit cards.

- Understand how an emergency fund works: A crucial way to prevent debt from building is to create an emergency fund, a savings account that you can draw from when unexpected expenses arise. A financially literate saver knows how much to set aside—ideally three to six months' worth of expenses—and replenishes it when necessary.

- Plan for retirement: While developing an emergency savings account, saving for retirement should be a concurrent long-term goal. When you've become financially literate, you can calculate how much to save and which types of accounts will help you get there.

How to Build Financial Literacy

If you're eager to become more financially literate, there are many tools you can use on your own to help understand and manage money.

- Start with tools available for free from your bank, credit union or credit card issuer. Your bank's app or website may help you track spending patterns. Several banks also offer free credit score tracking programs.

- You may also consider using a third-party budgeting app to keep track of spending and financial goals. A budgeting worksheet like the one provided by the Consumer Financial Protection Bureau (CFPB) is another option. (In fact, the CFPB offers many consumer tools on a range of topics, including guides on how to make financial decisions such as buying a house.)

- Local resources such as your state's consumer protection agency or attorney general's office provide support for consumers and may offer educational programs on financial topics. Credit counseling agencies, which employ counselors certified in budgeting and debt reduction techniques, also are useful local options.

- If you have the means, consider working with a financial advisor, such as a certified financial planner. They have deep expertise in complex financial goal-setting, and their services can include guidance on tax planning, saving for college and retirement, and paying down debt. You can search for a certified financial planner in your area, or one you can work with remotely, using databases like the XY Planning Network or the Garrett Planning Network.

Why Understanding Credit Is Important to Your Financial Literacy

Lenders use your credit score to decide whether to work with you, and landlords may use your credit score to determine whether you qualify for an apartment. Your credit score is the backbone of your financial life, and having a good one gives you the opportunity to meet financial goals like buying or renting a home.

To develop behaviors that strengthen your credit score, familiarize yourself with the factors that contribute to it:

- Payment history: Payment history is the biggest contributor to your FICO® Score☉, the credit score most commonly used by lenders, accounting for 35% of it. Pay all bills on time to keep this important part of your credit as strong as possible.

- Credit utilization: The amount of credit you use compared to your credit limit is your credit utilization, which accounts for 30% of your score. Experts say using more than 30% of your available credit can negatively affect your scores. Ideally, pay off credit card balances each month to keep your credit utilization as low as possible.

- Credit mix: The different types of credit you use factor into your score, but less significantly than payment history or credit utilization. Lenders like to see that you can manage multiple categories of credit, from student loans to credit cards to mortgages.

- Hard inquiries: Having credit is important, but only apply for the credit you need. That's because your credit score incorporates the number of credit applications you've made. Every application causes a lender to pull your credit report, resulting in a hard inquiry. Hard inquiries show up on your credit report, and too many will start to affect your credit score and appear as a risk factor to lenders.

- Negative information: If you miss a bill payment, declare bankruptcy or otherwise demonstrate that you did not manage a credit account as agreed, that information will appear on your credit report for seven years in most cases and up to 10 years for severe infractions. Lenders will take this into consideration when deciding whether to approve you for new credit.

Check your credit score, bank accounts and credit card balances regularly to maintain an ongoing picture of your finances. When you view your credit report, you'll be able to see whether your credit card balances are too high, for instance, or if you've missed a payment and need to course-correct so you don't miss any more. Knowing your credit score also helps you determine which loans or credit cards you're likely to qualify for.

Knowledge Is Power

Mac Os Catalina

Financial literacy is not a luxury—it's a necessity. Understanding money management will help you feel in control of your finances. Ideally, with strong financial literacy, you'll be confident in money management to the point where you can focus your energy elsewhere: on hobbies, family, friends and the parts of life that money can't buy.

National Financial Capability Month 2021

'My Administration is working hard to help Americans overcome the financial impact of COVID-19 and the deep-rooted inequities in our society that have greatly limited the economic prosperity of too many Americans. Given the disproportionate impact the pandemic is having on minority and low-income communities, a concerted effort by the Federal Government is necessary for recovery and building back a better economy. Financial education that builds financial capability helps families receive assistance, build resilience, and benefit from a stronger and more equitable economy. April is recognized as National Financial Capability Month to highlight the value of high-quality financial education to improving Americans' financial capability.'

- President Joseph R. Biden Jr.

What is National Financial Capability Month?

In 2004, the U.S.Congress (opens new window) designated April as National Financial Literacy Month, which has evolved into National Financial Capability Month. Each April, federal and state agencies, credit unions, schools, nonprofit organizations, businesses, and other entities take part in this initiative to raise awareness about the importance of financial literacy education in the United States and the consequences that may be associated with a lack of understanding about personal finances.

Why is Financial Literacy Important?

Financial literacy is key to understanding how to save, earn, borrow, invest, and protect your money wisely. It is also essential to developing short- and long-term financial habits and skills that lead to greater financial well-being. Becoming financially literate could be as simple as:

- Using a budget worksheet (opens new window) to determine which expenses are flexible or fixed, as well as, ensure you have enough emergency savings to prepare for unexpected expenses; or

- Pulling your credit report once a year to make sure the information is accurate, complete and up-to-date and you are not a victim of identity theft.

How are NCUA and Credit Unions Involved?

Under the Federal Credit Union Act, promoting financial literacy is a core credit union mission. While credit unions serve the needs of their members and promote financial literacy within the communities they serve, the NCUA works to reinforce credit union efforts, raise consumer awareness and increase access to credit union services. The NCUA also participates in national financial literacy initiatives, including the Financial Literacy and Education Commission, an interagency group created by Congress to improve the nation’s financial literacy and education.

In addition, the NCUA partners with the Federal Deposit Insurance Corporation and the U.S. Department of Education in a Youth Financial Education Collaboration Agreement, aimed at helping students and families save for college and encouraging the development of smart money habits. NCUA is also a national partner of the Jump$tart Coalition (opens new window) for Personal Financial Literacy.